Establishing appropriate utility rates is crucial for providing sustainable solid waste management services. Like any public utility, sanitation is an essential service that is critical to our society. Typically, a solid waste utility for a city or county is operated as a self-funded program under an enterprise fund. These types of funds are separate from other government activities and funding mechanisms. The fund is self-supporting by generating its own revenues and expenses without relying on tax proceeds. Without any other means of revenue, setting the right solid waste rate structure is critically important.

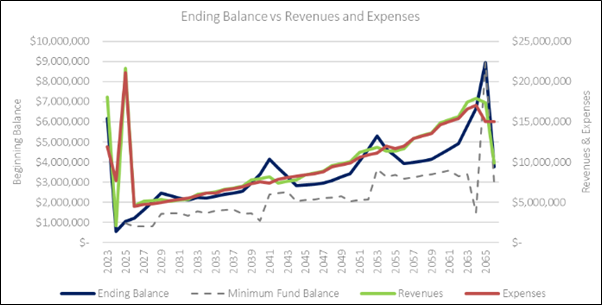

In simple terms, solid waste rate studies evaluate the sufficiency of revenues to pay for operating expenses and capital improvements. Another important reason for a rate study is to determine if fees are being assessed fairly amongst the users. Public utilities use a variety of ways to generate revenue to pay for the expense of operating and managing their solid waste system. These may include special property assessment fees, gate fees (tipping fees), and special waste material handling fees. Another important element of a rate study is fair and equitable cost recovery. Are rates for businesses and residential customers in the same community equitable? Is either of the parties not paying their fair share?

Waste Being Collected Curbside for Residential Customers

Many counties in Idaho utilize a special property assessment fee that is included in the annual tax bill. Oftentimes, counties will group rates into two main categories – residential and businesses. For example, a county may set an annual fee for a residential property at $50 while a business (or commercial) property is set at $100. In this case, is a business generating on average twice as much trash as a residence? Equity must be provided between residential and businesses as well. An entity should not be penalized for being a business if it is generating as much trash as a residence.

At Great West, we have found that a good starting point for communities suffering from revenue shortfalls is to assess solid waste rates for businesses. Although businesses may generate more trash than residences, businesses are not all the same. For example, a small drive-through coffee shop that fills one garbage can each week might be charged the same as a grocery store that fills several dumpsters. To determine how much trash a business throws away, the county or city needs to work with their garbage collection companies to get information about the size and number of containers, an estimate of how full the containers are on an average basis, and the frequency of pickup. This information can then be entered into a rate assessment model to set rates that are fair and equitable for all businesses based on the amount of garbage they generate.

Similarly, residences that have been subdivided or have multifamily housing will tend to generate more garbage than a single-family home. To be fair and equitable, the rate should account for these types of residences especially when it comes to multi-family housing. Most often, those properties are categorized as businesses and charge accordingly.

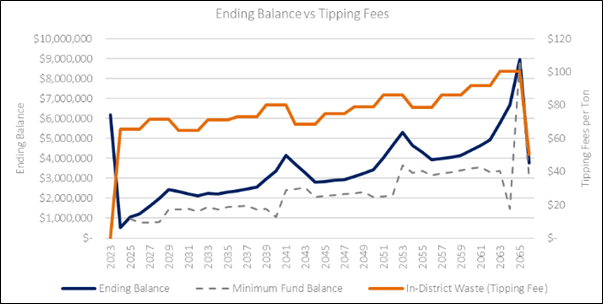

Other communities may not have property assessment fees and rely solely on gate fees (or tipping fees) for their revenue. A tipping fee is a fee that is paid by those that dispose of waste at a solid waste facility. This could be at a landfill or a transfer station. The fee is typically assessed on a per weight basis which allows the fee to be assessed fairly across all users. Rate setting for this type of program can be much easier than property assessed fees by establishing one single fee on a per ton basis.

In summary, establishing rates that provide sufficient revenue and that are also fair and equitable for users is important for the long-term sustainability of a utility. Solid waste utilities are no different. One thing they have in common is that they are all in the business of providing safe and reliable sanitation services that are essential for our society. The types of rates and how they establish those rates may be different.

Great West has been helping communities set fair and equitable solid waste rates for their solid waste utility for more than 30 years. We develop simple, non-proprietary models for our clients using basic programs such as Microsoft Excel. With some instruction, our clients can continue to use the model for annual budgeting and rate setting. To learn more about how our team can help your community, contact us today.

LATEST NEWS

Stormwater Planning – The Calm Before the Storm

Stormwater planning and management often falls behind as a priority for communities. This is understandable with the ever-present demands for providing clean drinking water and adequate collection and treatment of wastewater, along with many other competing needs for resources to keep a community running.

5 Tips to Increase Your Chances of Receiving Grant Funding

A few years ago, Idaho and Montana went from being Lewis and Clark’s rest stops as they endeavored to find the Pacific Ocean to one of the best places in the region to call home. All of us born and raised in these regions, while we aren’t surprised in the least that people want to move here, are finding it challenging to accommodate this unprecedented growth.

Summer Interns 2025

With summer in full swing and classrooms on pause, it’s time once again to welcome a new class of bright minds ready to dive into the world of engineering. At Great West, we believe in investing in future leaders, and our internship program is one way we live out our commitment to growth, mentorship, and empowerment.